Blanco Investment Suite for asset managers

Volledige automatisering van de vermogensbeheercyclus, waarbij uw expertise centraal blijft staan.

Bij Blanco geloven we niet enkel in technologie. We geloven in de symbiose tussen mens en machine. Daarom hebben we een Investment Suite ontwikkeld die de volledige vermogensbeheercyclus automatiseert, maar tegelijkertijd uw expertise centraal stelt: zie onze technologie als uw eigen digitale beleggingstool, terwijl u gewoon zélf degene blijft die alle beleggingsbeslissingen voor of met uw cliënten neemt. Daarbij voldoet onze Investment Suite altijd aan de laatste wet- en regelgeving en houdt het u op de hoogte als er actie moet worden ondernomen.

Met Blanco wordt uw bedrijfsvoering minder complex, efficiënter en kosten-effectiever. Oftewel: door automatisering geeft onze Investment Suite u de vrijheid om meer tijd aan uw cliënten te besteden. En dat is belangrijk, want volgens ons kan financiële dienstverlening niet zonder menselijk vertrouwen en empathie. Blanco helpt u als mens om concurrerend te blijven in een door technologie gedomineerde toekomst.

Portfolio Management System

- Use the CRM module to manage your tasks and capture all relevant information from prospects and clients (personal data, conversations, digital documents, events, scenario analyses, etc.)

- Fully adaptable to your way of working, for example: consolidation of reporting, management of your own portfolios, interface in your own design, management of all assets, including non-banking ones, etc.

- Collecting and processing data from more than 50 European custodians and a dedicated operations team ensures data verification.

- Generating and distributing orders using the FIX protocol.

- Invoice your customers using multiple calculation definitions.

- Create asset pools and link them to model portfolios to increase efficiency.

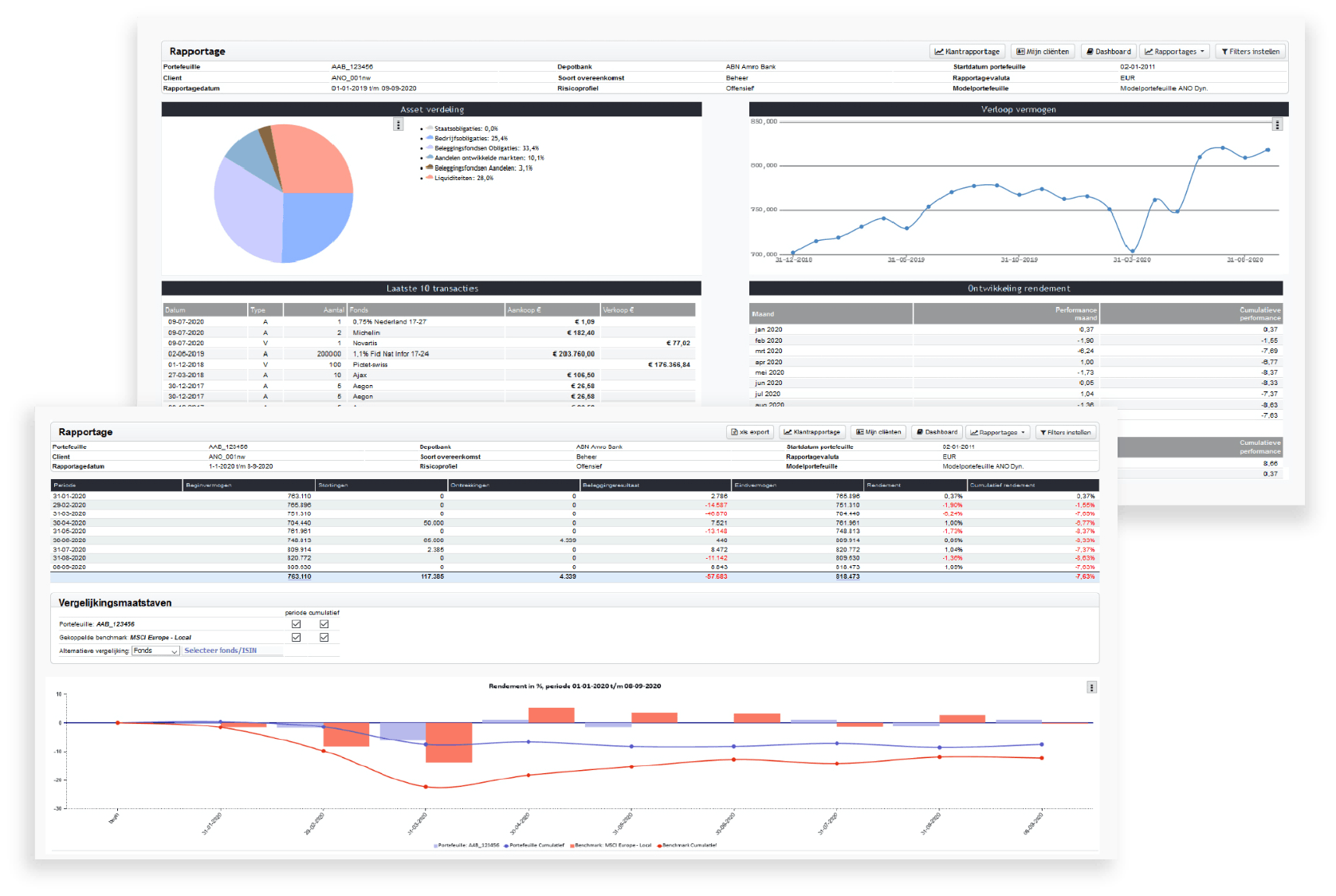

- Use the reporting feature to keep clients informed about the performance of their portfolio and share predictions about achieving financial goals.

- Periodically rebalance your customer portfolios via the automated order generator.

Experience the Blanco Investment Suite yourself

Ask us anything about our solutions or our pricing

Use cases

— Paul Kramer, mede-eigenaar van Index Capital:

“Blanco is inmiddels volledig geïntegreerd in onze dagelijkse praktijk.”

Technology assisted by expert services

Our knowledge is always accessible to our clients.

Instead of being imposed on people, our Wealth Management Platform serves people. That’s why our technology is designed for a superior user experience. Nevertheless, we understand that adopting a new fintech platform is never fully seamless.

Know that we offer full guidance to help you get accustomed to the Blanco Clients Suite and/or Assets Suite quickly. We’re also happy to share our industry knowledge and love to be your sparring partner when it comes to rules and regulations.

Compliance Advice

We assess your compliance documentation and procedures, and share advice for possible improvements. Blanco also offers guidance when it comes to the implementation of rules and regulations, and can help you with your license application.

ISAE 3402 Guidance

An ISAE 3402 certification provides insight into critical processes within an organization and shows whether the company is ‘in control’. Blanco offers guidance in the ISAE 3402 certification process.

Business Process Outsourcing

In combination with the Securities Administration module of the Blanco Assets Suite, you can outsource your securities operations to us, if you’d like. Let us take care of operational tasks like reconciliation and corporate actions for you.