Blanco KYC & Compliance Suite for wealth managers

Your KYC procedure done in minutes, instead of days.

At Blanco, we’re developing financial technology with humans in mind. That’s why we’ve come up with a client data management solution that focuses on an ultimate user experience: our KYC & Compliance Suite automates client data collection, storage and management for you. Being compliant to KYC rules and regulations on a continuous basis becomes a breeze with our KYC & Compliance Suite.

Using our technology, you’ll experience that KYC rules and regulations aren’t just annoying legal obligations anymore. In fact, they represent an opportunity to genuinely get to know your client: you can easily and securely access all data, anytime, anywhere. But most importantly, our platform sets you free to spend more time on your clients: isn’t that the best way to grow your business?

Find out how our KYC & Compliance Suite also helps other investment funds.

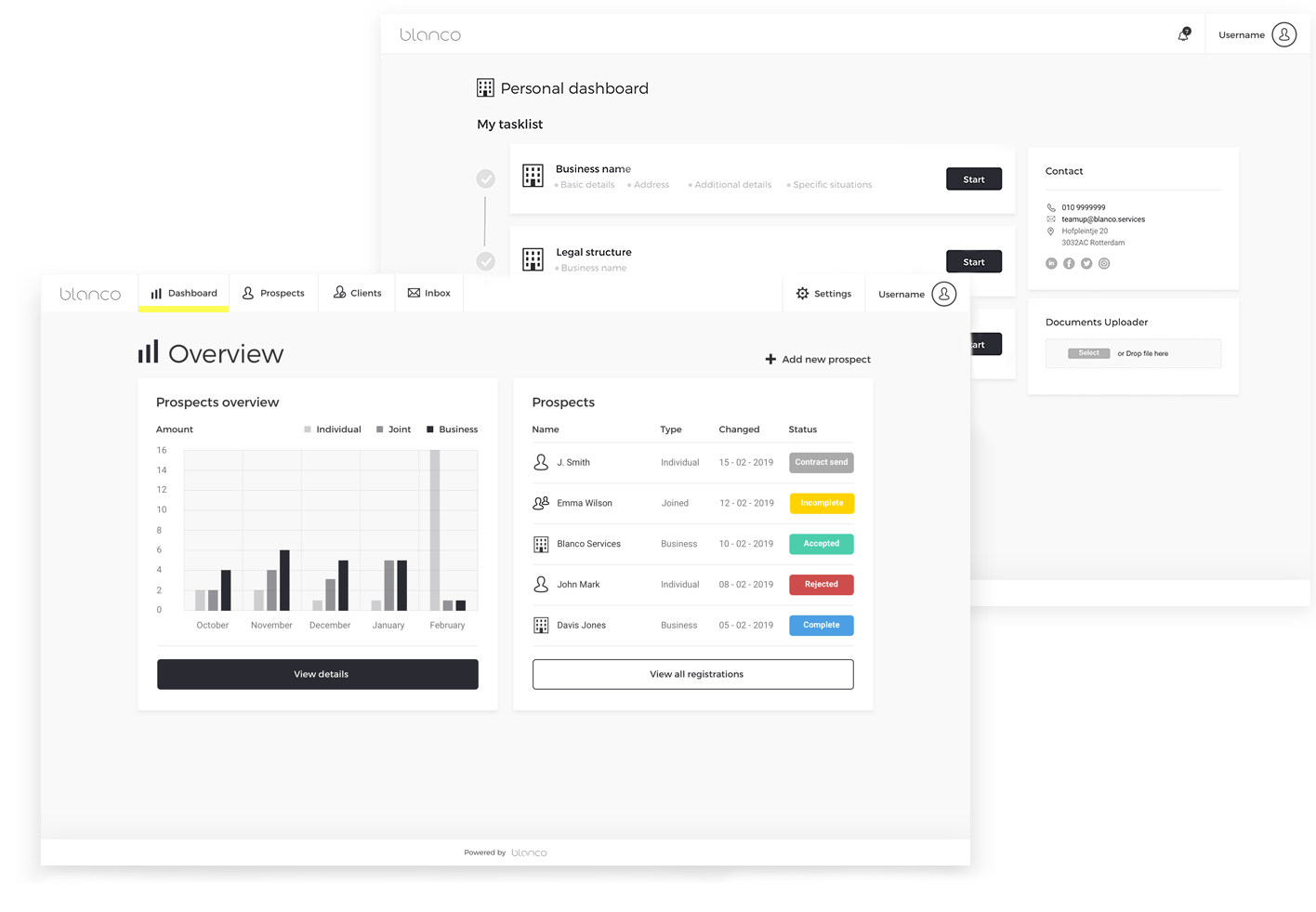

Client Onboarding

- Developed to onboard all natural persons and legal entities.

- User-friendly interface, accessible through desktop, mobile and tablet.

- Add bespoke client surveys and questionnaires.

- Identify and verify your clients through a passport scan, liveness check and derived identification.

- Screen your clients on adverse media (bad press), PEP and elaborate global sanction lists.

- Generate and sign contracts through e‑identity: SMS, iDEAL, iDIN, ITSME or E‑Identity.

- Also applicable to executing a client data overhaul: reassess and update all your current client data.

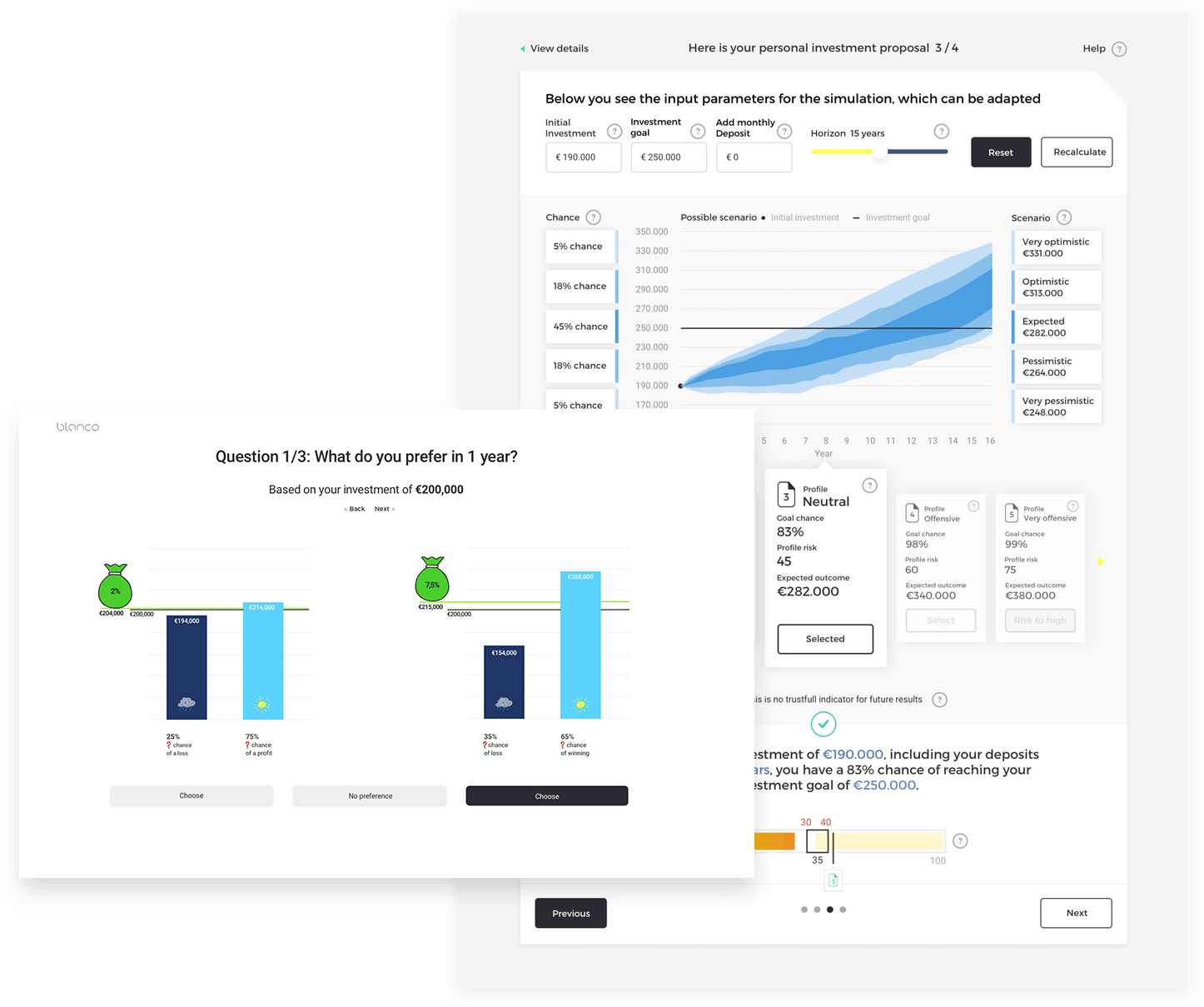

Financial Investment Plan

- Suitability: define your client’s knowledge and experience to provide services accordingly.

- MiFID risk assessment: assess your client’s risk appetite using risk-weighted questionnaire answers based on a scientific model.

- Use the built-in Monte-Carlo simulations to calculate the probability of achieving investment objectives.

- Automatically generate goal-based investment proposals for your clients.

- Easily link the Blanco KYC & Compliance Suite to your proprietary model portfolios.

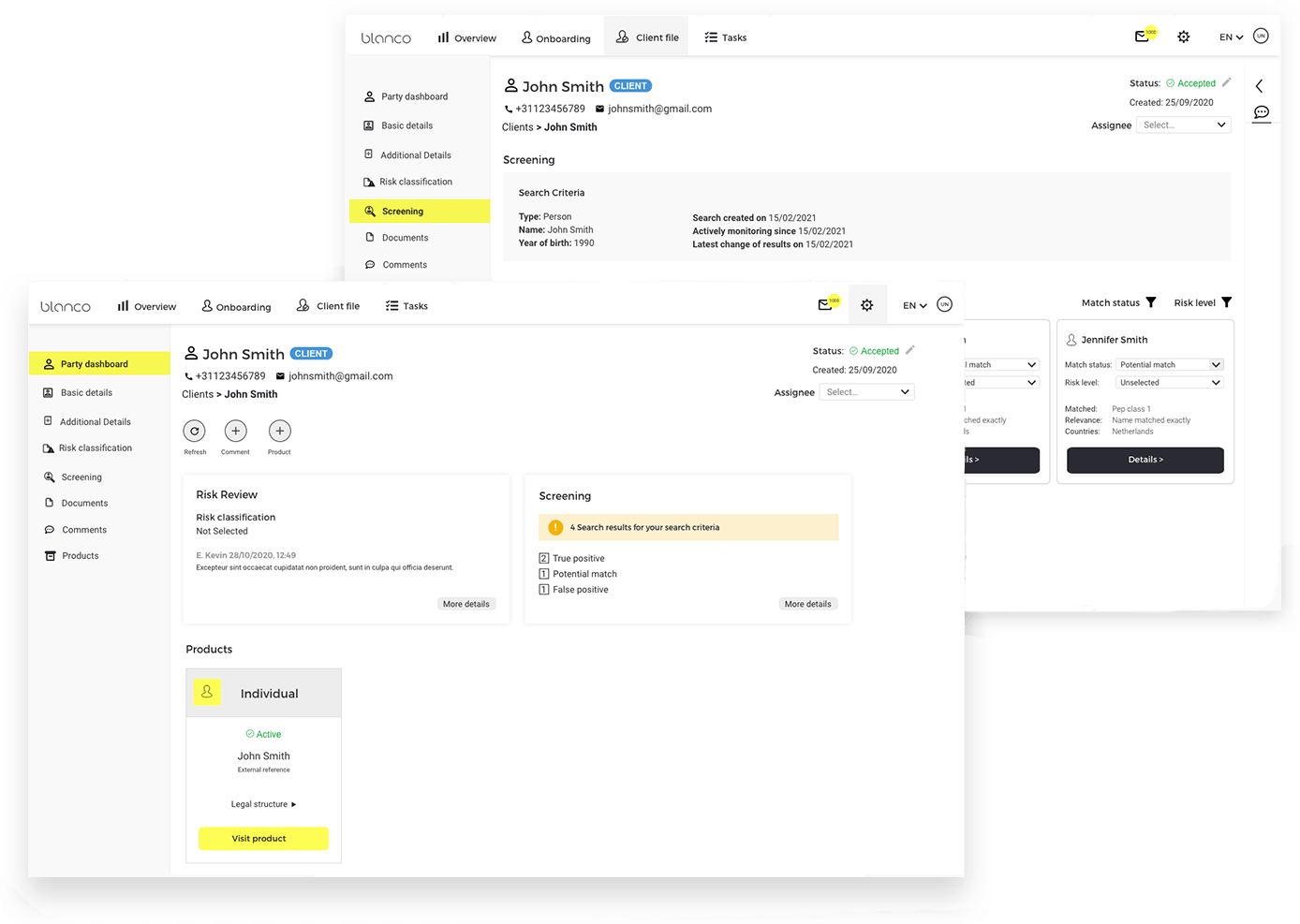

Client File

- Extended CRM functionality: store, maintain and update client data, such as basic client information, notes, due diligence and risk assessments on a continuous basis.

- Use the incorporated AML Client Classification to get relevant notifications on client reassessment.

- Enable compliancy to your regulator by using our built-in evidence-based audit trail.

- Continuously screen your clients on adverse media (bad press), PEP and elaborate global sanction lists.

- Easily create and close new contracts with your clients.

- Trust our product-relationship structure: clients are always connected to their respective products.

- Schedule notifications for client contact and tasks for you and your client.

Use cases

— Hatim Chebti, CEO Franx:

“Blanco is as customer obsessed as we are.”

— Paul Kramer, co-owner of Index Capital:

“Blanco is now fully integrated in our daily practice.”

Technology assisted by expert services

Our knowledge is always accessible to our clients.

Instead of being imposed on people, our Wealth Management Platform serves people. That’s why our technology is designed for a superior user experience. Nevertheless, we understand that adopting a new fintech platform is never fully seamless.

Know that we offer full guidance to help you get accustomed to the Blanco Clients Suite and/or Assets Suite quickly. We’re also happy to share our industry knowledge and love to be your sparring partner when it comes to rules and regulations.

Compliance Advice

We assess your compliance documentation and procedures, and share advice for possible improvements. Blanco also offers guidance when it comes to the implementation of rules and regulations, and can help you with your license application.

ISAE 3402 Guidance

An ISAE 3402 certification provides insight into critical processes within an organization and shows whether the company is ‘in control’. Blanco offers guidance in the ISAE 3402 certification process.

Business Process Outsourcing

In combination with the Securities Administration module of the Blanco Assets Suite, you can outsource your securities operations to us, if you’d like. Let us take care of operational tasks like reconciliation and corporate actions for you.